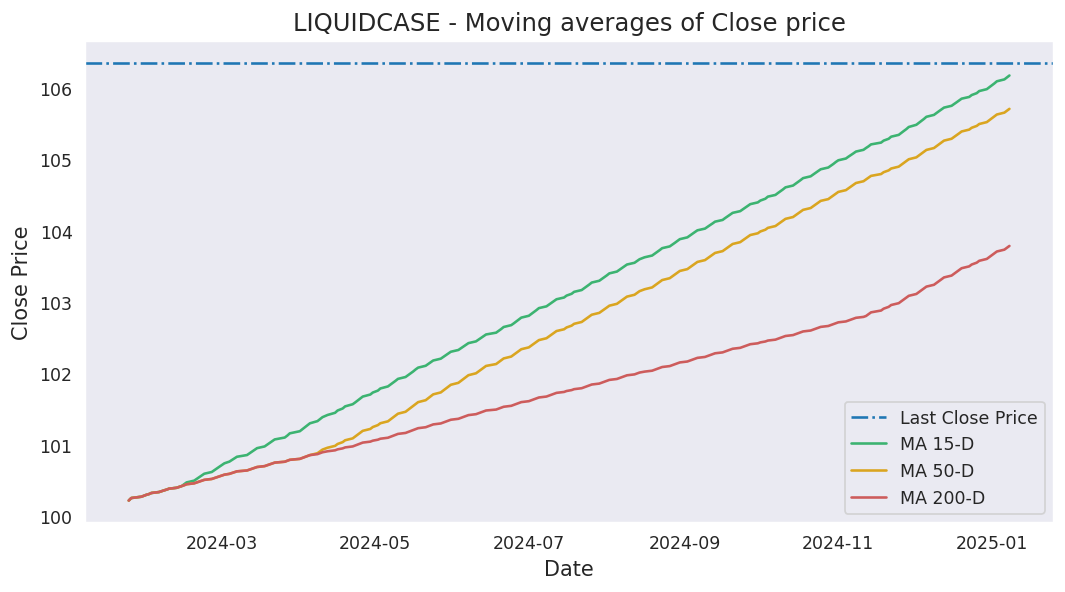

Moving averages

Last close price: 112.47

Average of last 15 days: 112.29

Average of last 50 days: 111.89

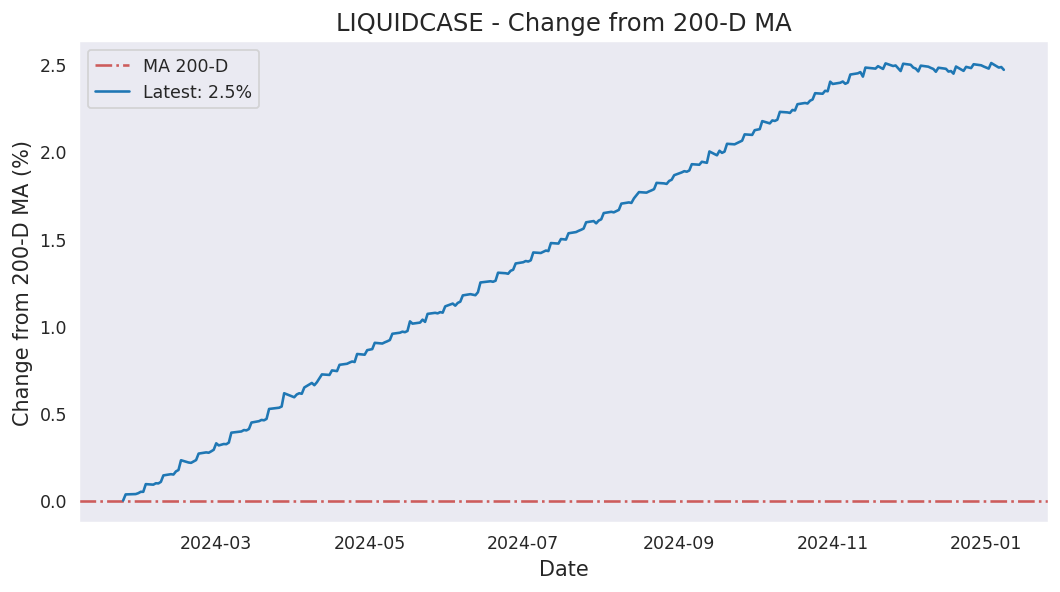

Average of last 200 days: 110.21

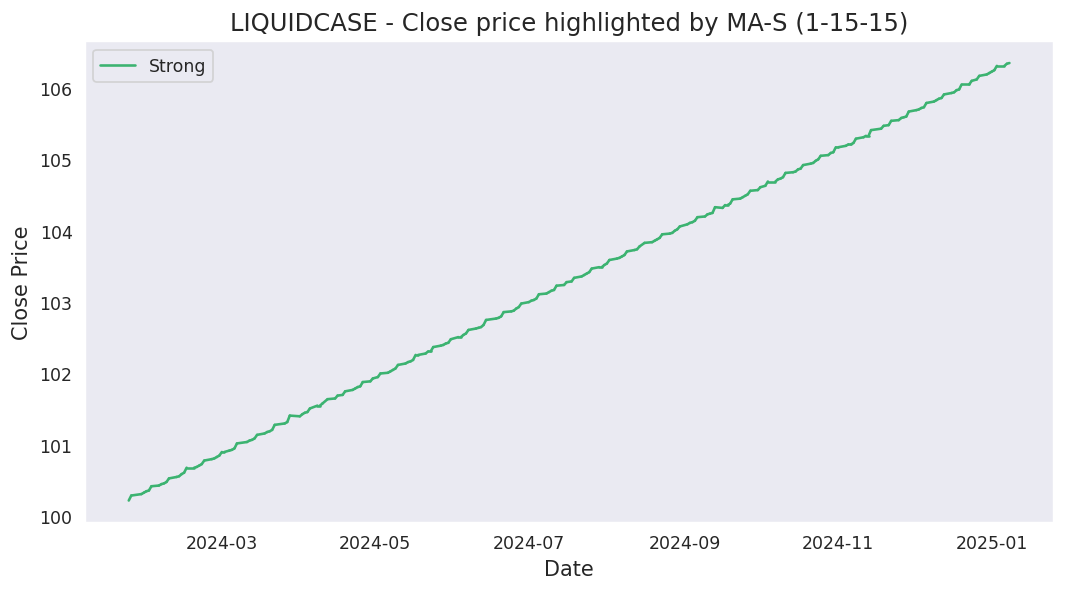

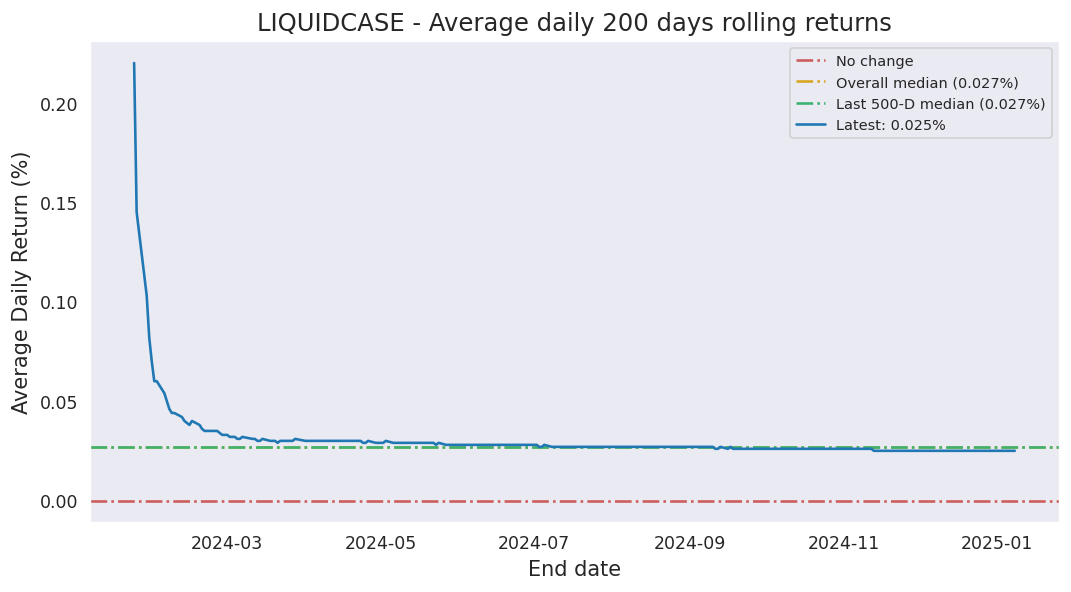

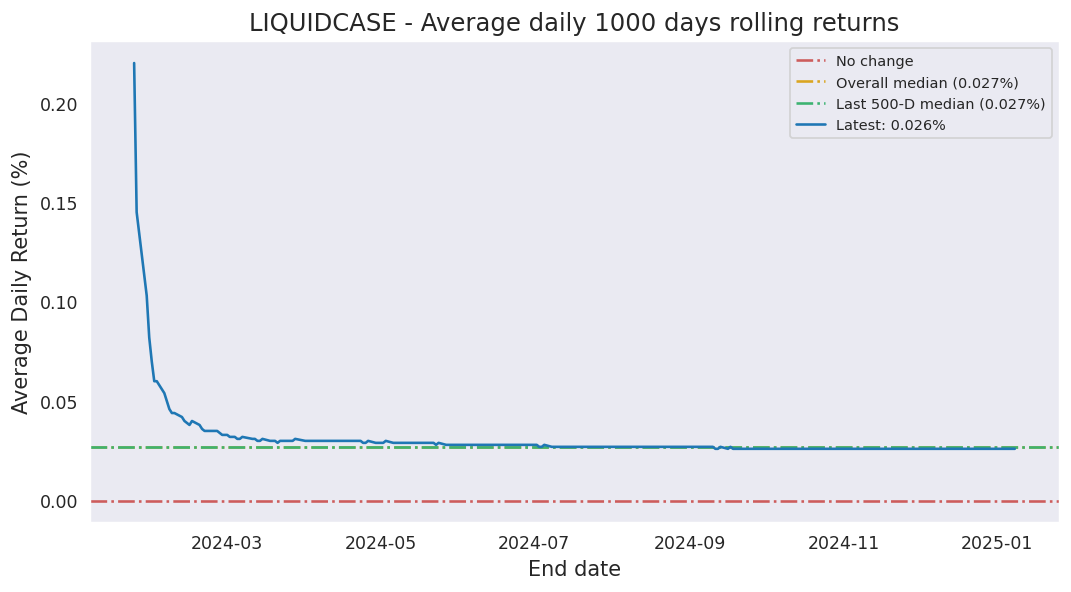

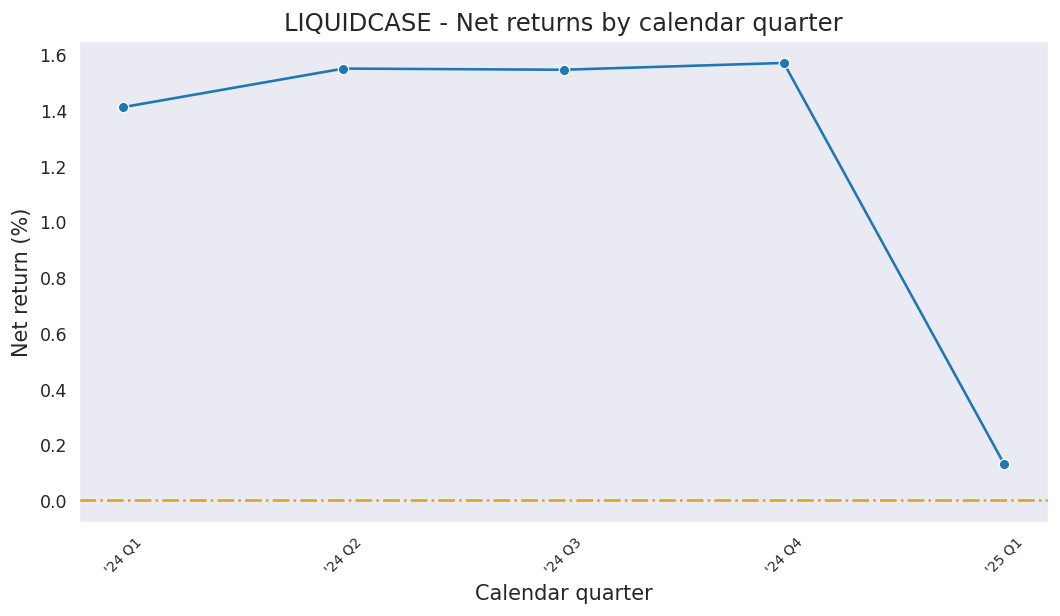

Analysis based on 497 records from January 24, 2024 to January 23, 2026

Last updated on January 30, 2026

| 5 Days | 15 Days | 50 Days | 200 Days | 497 Days | |

|---|---|---|---|---|---|

| Start Date | January 19, 2026 | January 02, 2026 | November 13, 2025 | April 04, 2025 | January 24, 2024 |

| Net Return | 0.11% | 0.34% | 1.01% | 4.26% | 12.47% |

| Average Daily Return | 0.021% | 0.023% | 0.020% | 0.021% | 0.024% |

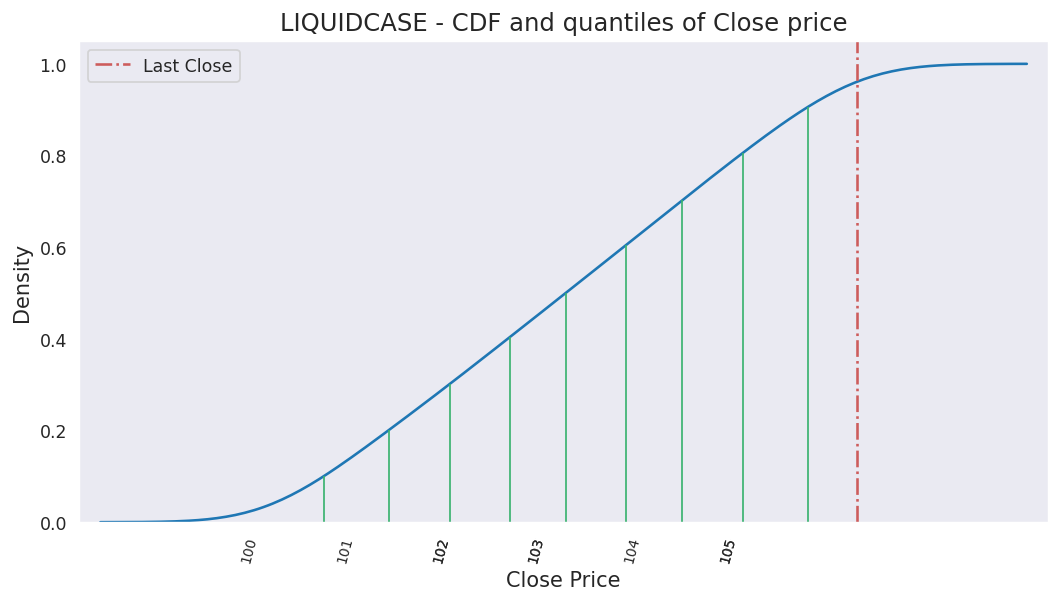

| Median Close Price | 112.39 | 112.28 | 111.88 | 110.21 | 106.63 |

| Lowest Close Price | 112.37 | 112.14 | 111.35 | 107.92 | 100.22 |

| Highest Close Price | 112.47 | 112.47 | 112.47 | 112.47 | 112.47 |

| Mean Value Traded | 2.15B | 2.23B | 1.73B | 1.23B | 845.91M |

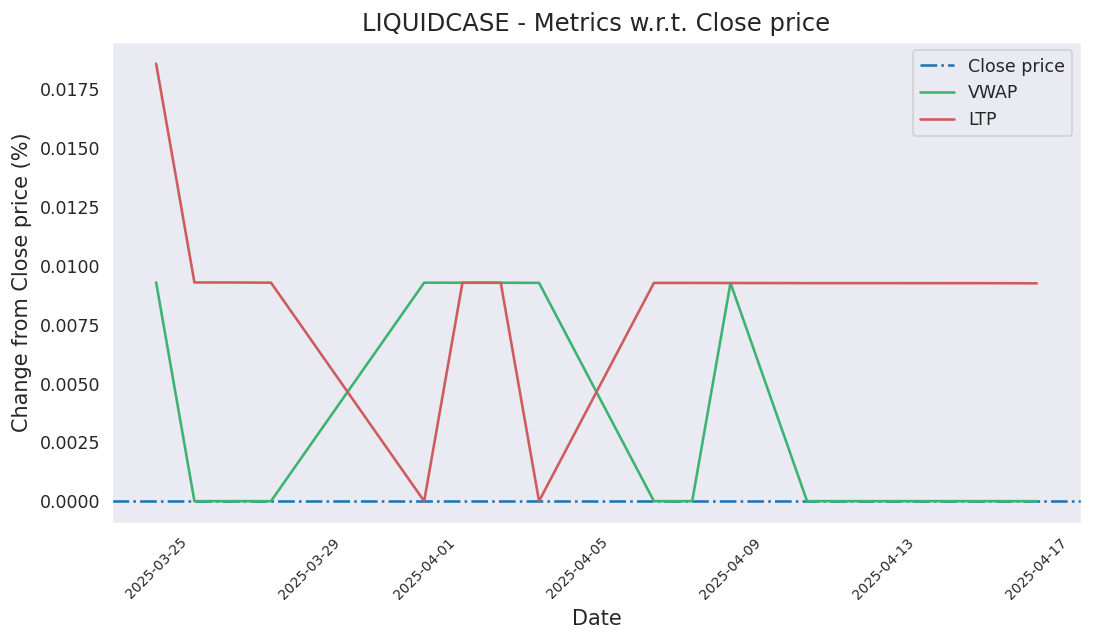

Last close price: 112.47

Average of last 15 days: 112.29

Average of last 50 days: 111.89

Average of last 200 days: 110.21

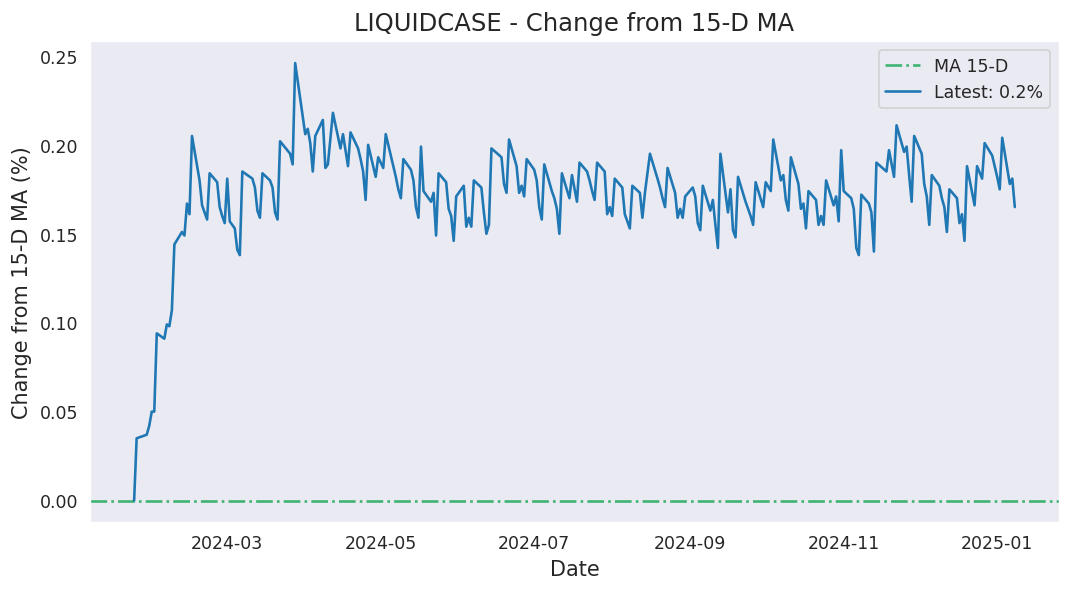

This is the first time LIQUIDCASE has closed at this high a price.

Since then, it has closed over this price 100.0% of times which is 1 trading days.

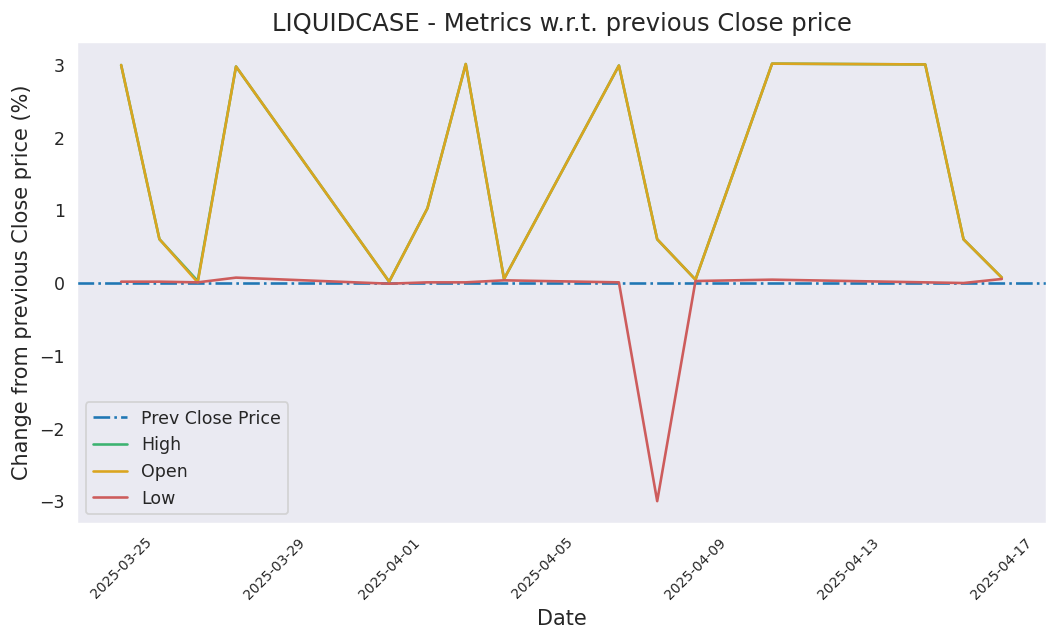

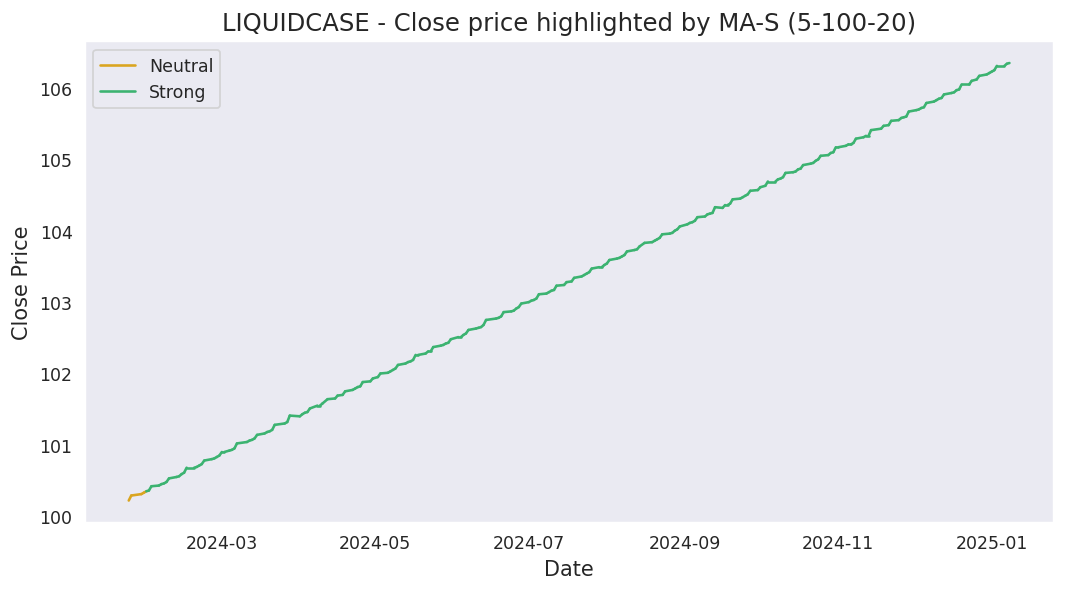

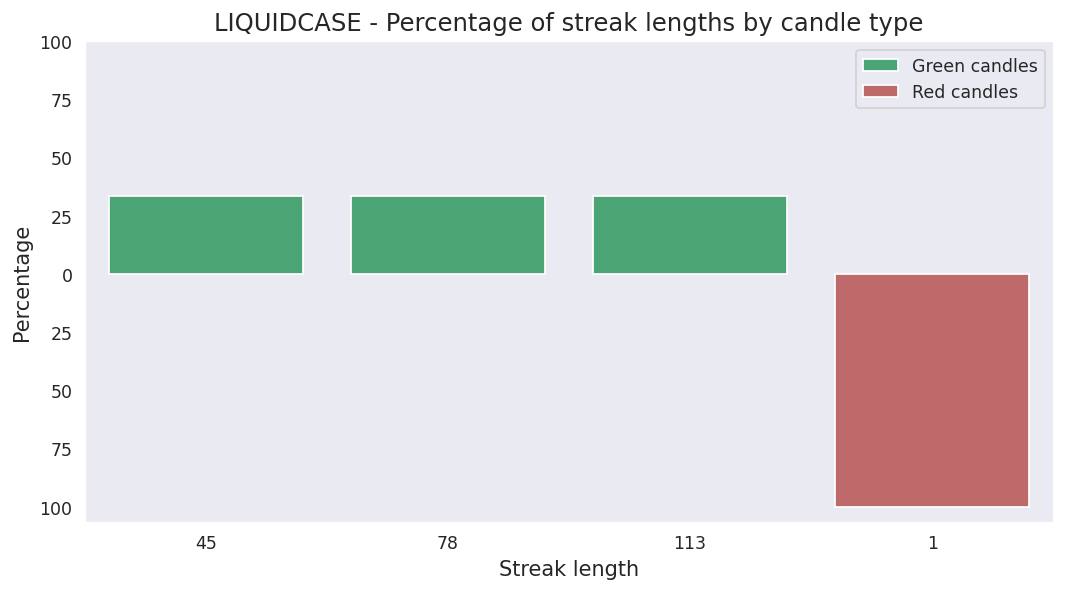

Historically, this stock gave a non-positive return for a maximum period of 4 days which was from March 28, 2024 to April 01, 2024.

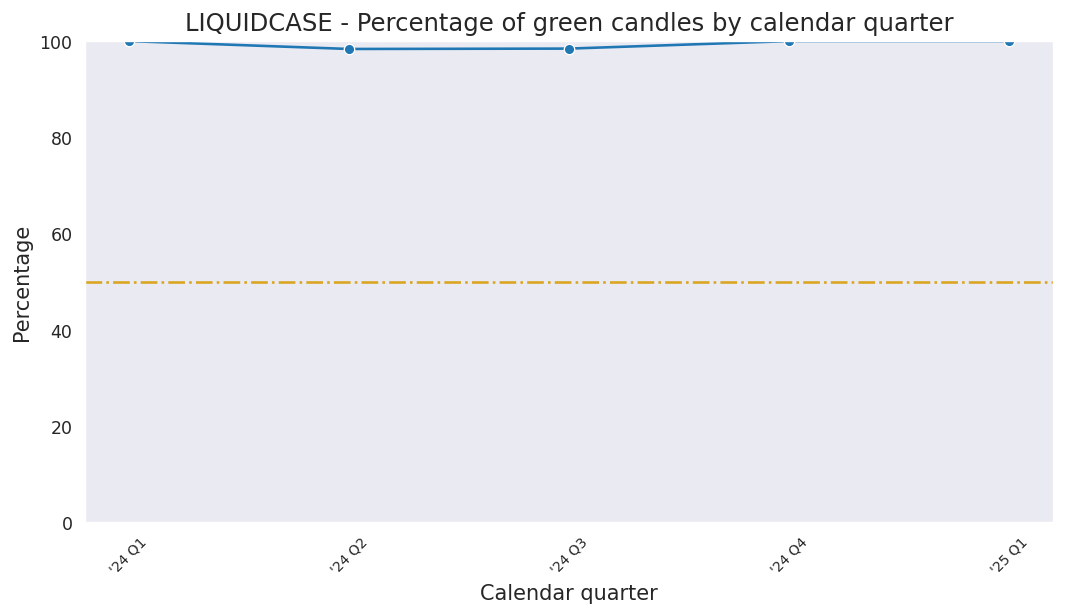

Last candle: Green (0.06%)

Overall percentage of Green candles: 99.2%

Current streak of Green candles: 94

Net change so far for the current streak: 1.95%

Probability of streak continuing: 75.0%

Longest streak of Green candles: 133 trading days from February 20, 2025 to September 05, 2025

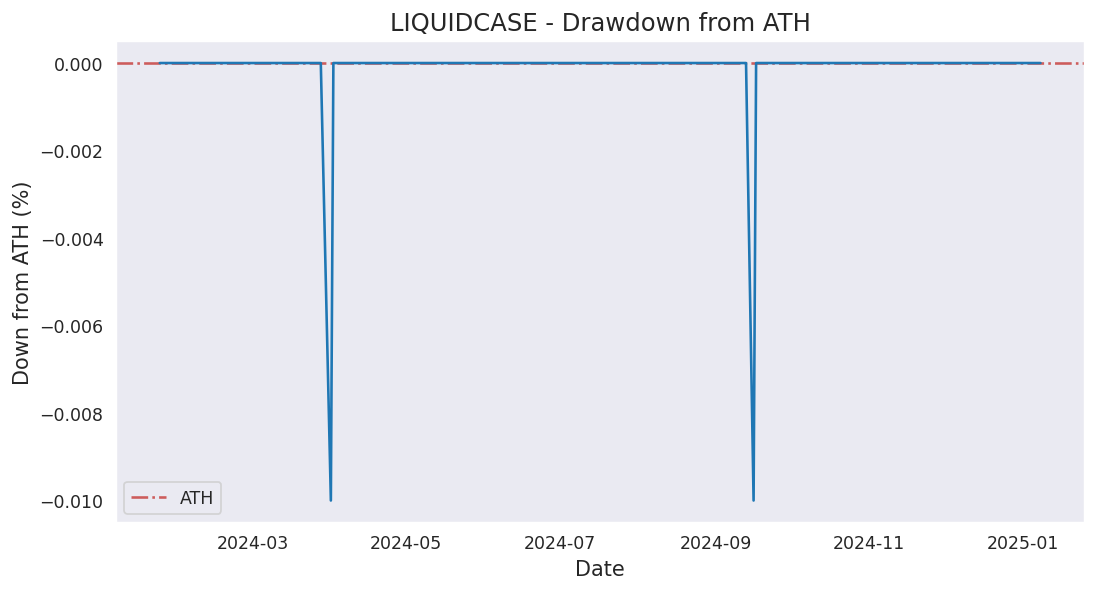

Current down from ATH: 0.00%

Most down from ATH: -0.01%

ATH hits in last 1000 days: 493

ATH was last hit on Friday, January 23, 2026.