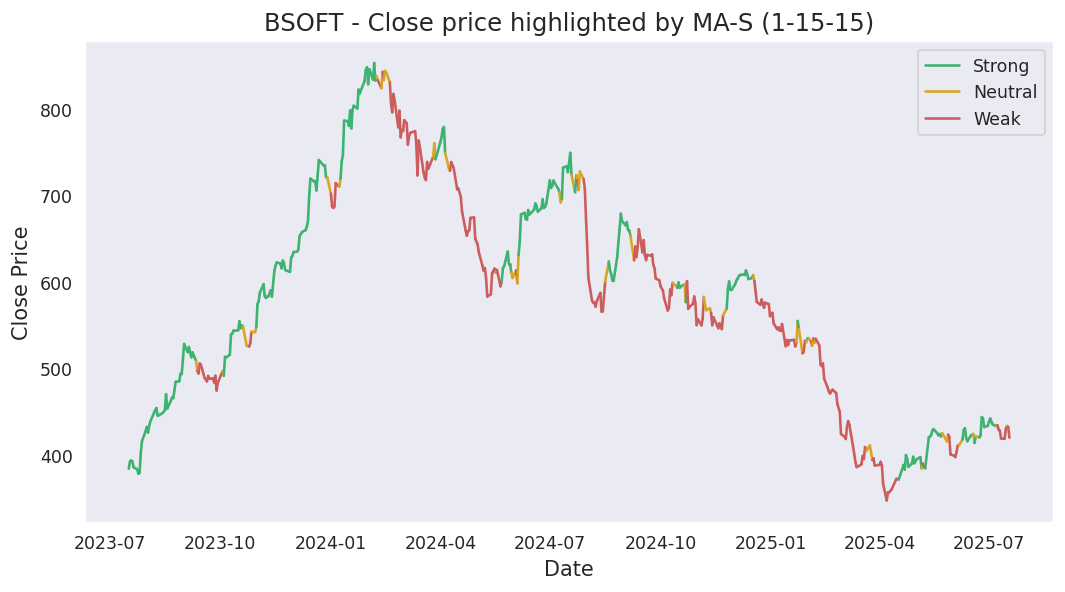

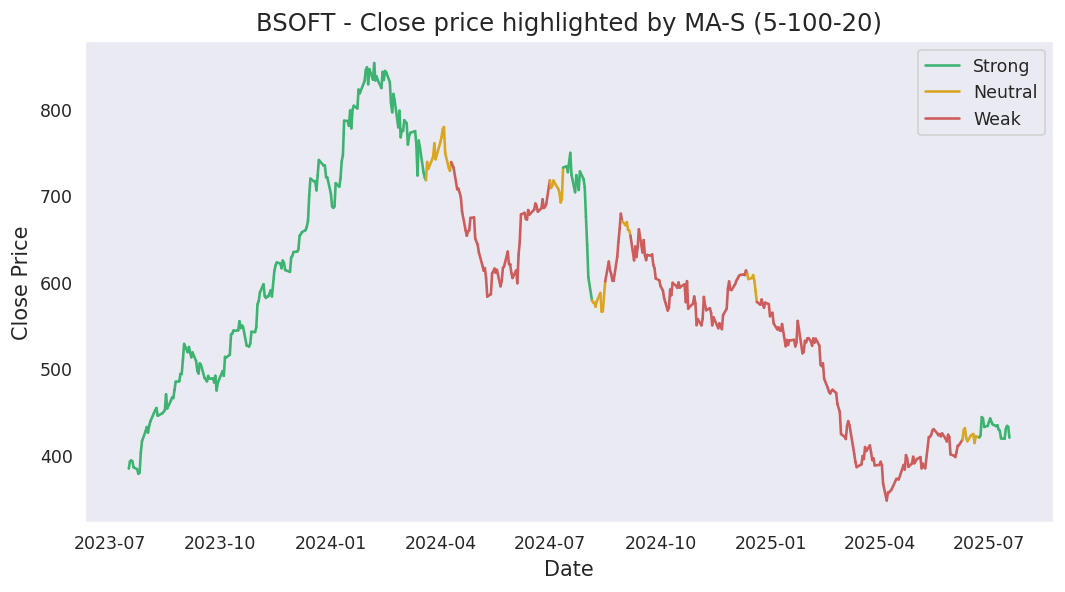

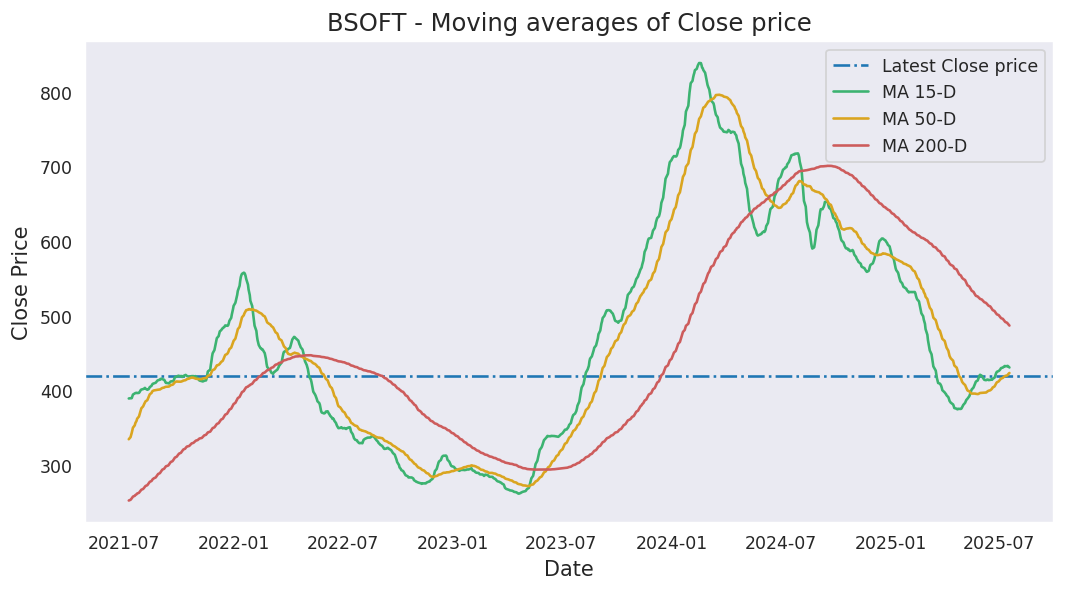

Moving averages

Last close price: 418.05

Average of last 15 days: 415.51

Average of last 50 days: 418.84

Average of last 200 days: 399.15

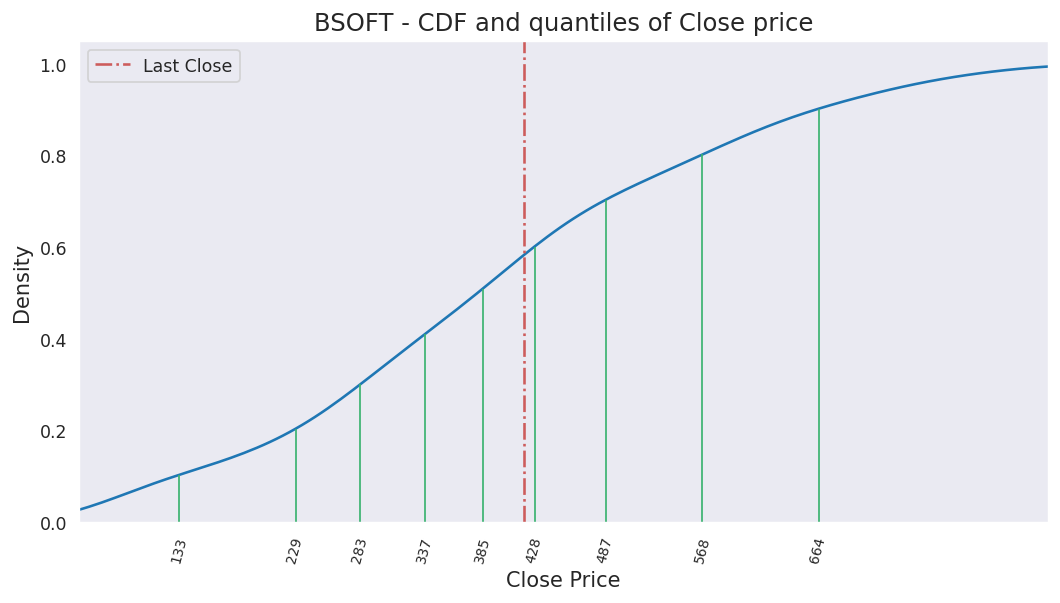

Analysis based on 1512 records from January 01, 2020 to January 30, 2026

Last updated on January 30, 2026

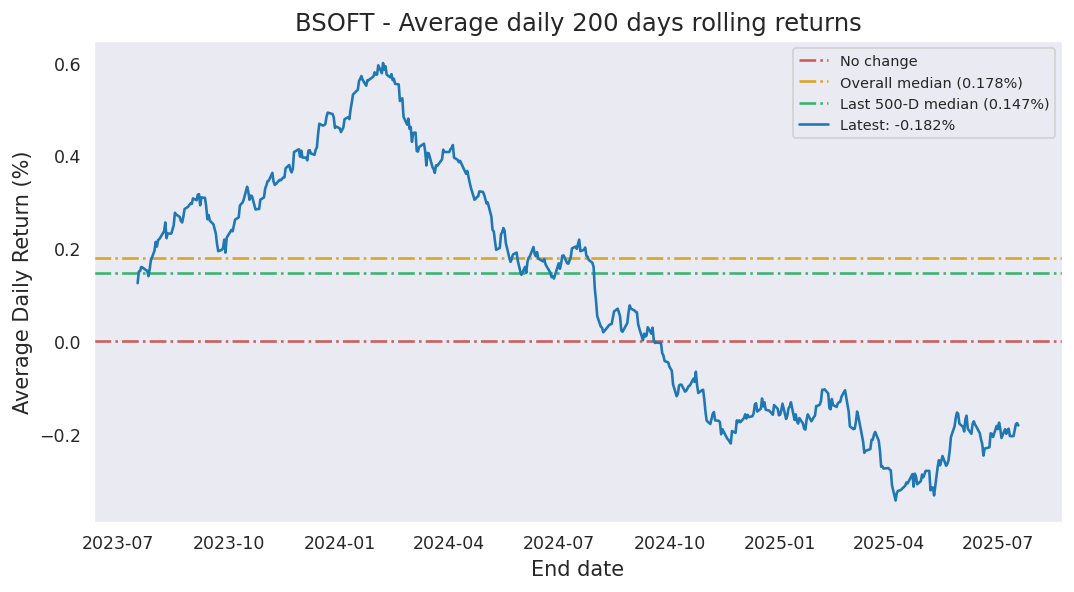

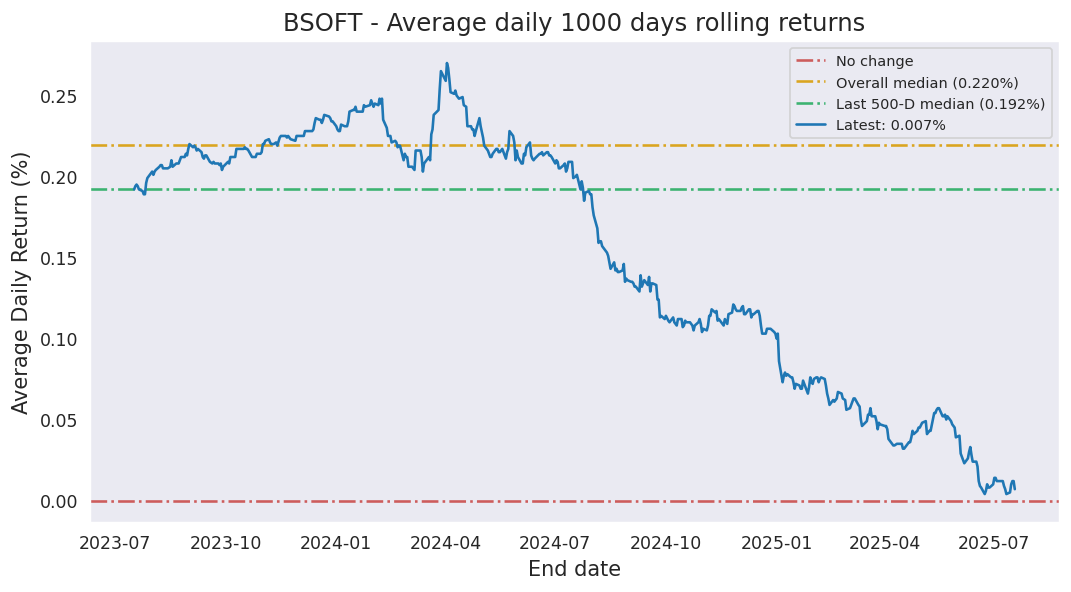

| 5 Days | 15 Days | 50 Days | 200 Days | 1000 Days | |

|---|---|---|---|---|---|

| Start Date | January 23, 2026 | January 08, 2026 | November 19, 2025 | April 11, 2025 | January 19, 2022 |

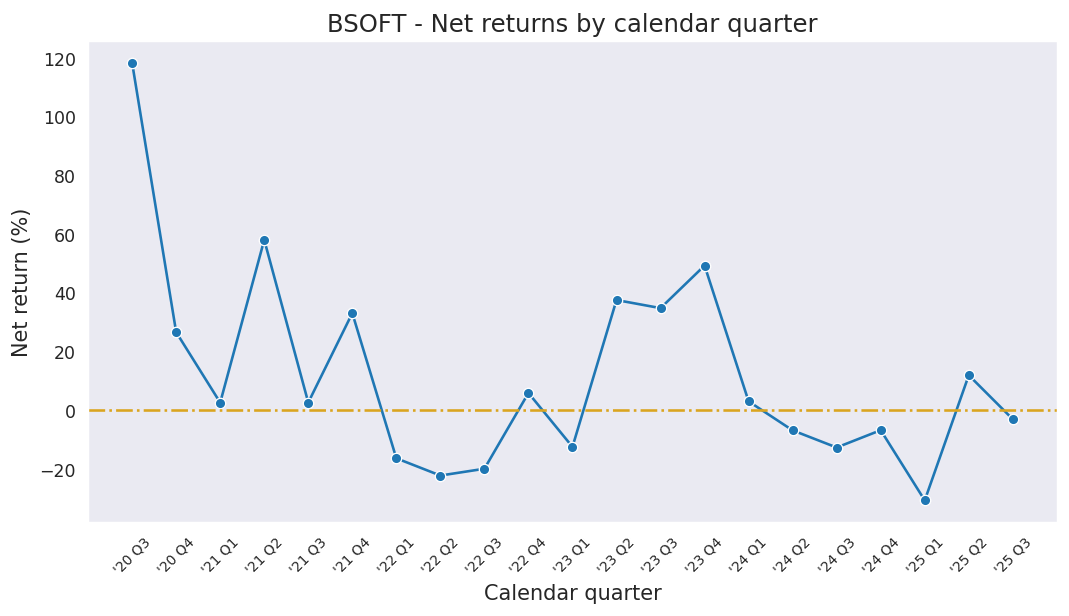

| Net Return | 0.64% | -5.72% | 10.06% | 17.20% | -21.82% |

| Average Daily Return | 0.127% | -0.392% | 0.192% | 0.079% | -0.025% |

| Median Close Price | 405.80 | 415.40 | 424.35 | 397.38 | 424.02 |

| Lowest Close Price | 398.70 | 398.70 | 380.00 | 338.95 | 251.75 |

| Highest Close Price | 418.05 | 433.10 | 455.85 | 455.85 | 853.40 |

| Mean Value Traded | 496.75M | 425.73M | 650.35M | 680.26M | 1.12B |

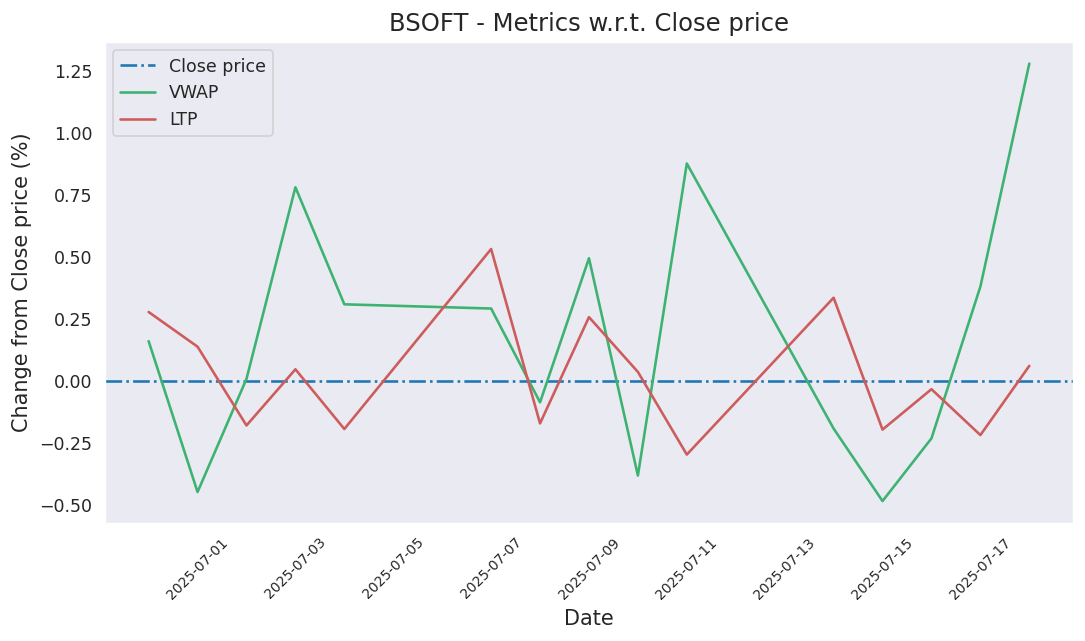

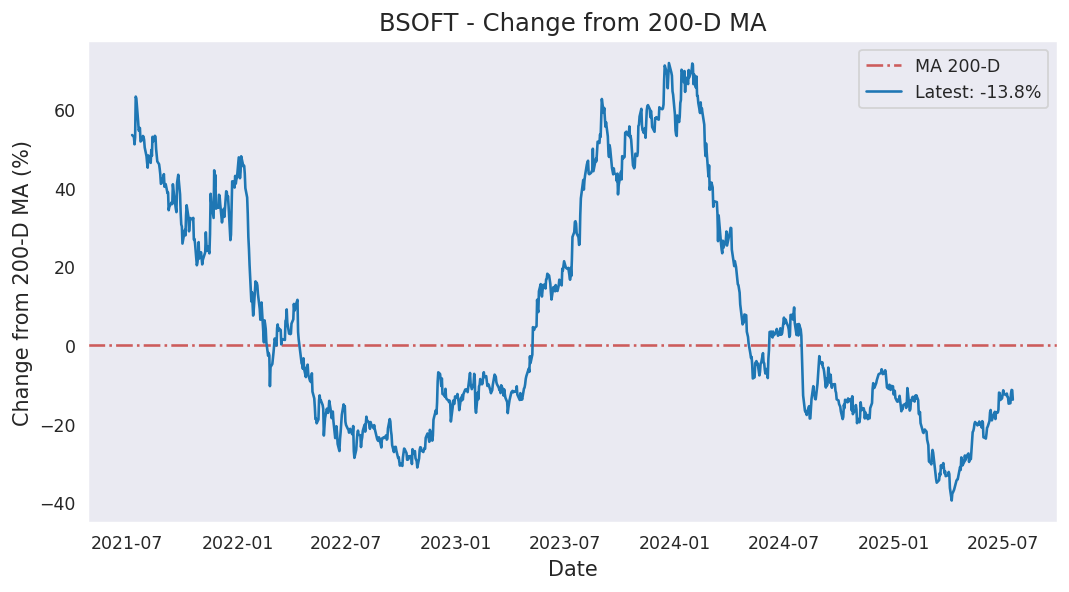

Last close price: 418.05

Average of last 15 days: 415.51

Average of last 50 days: 418.84

Average of last 200 days: 399.15

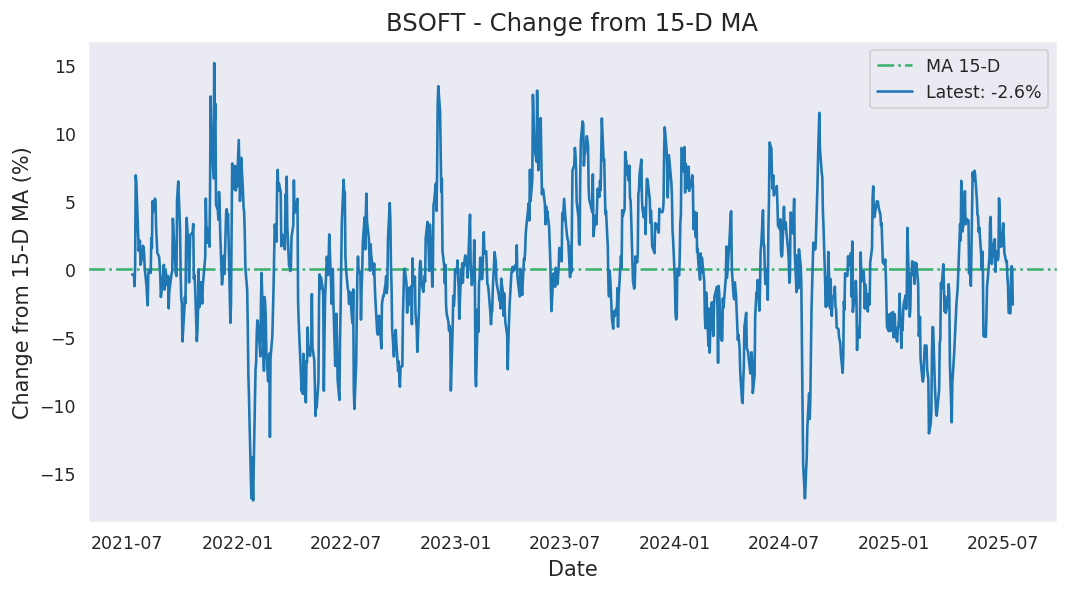

BSOFT first closed above its last close price on Thursday, July 15, 2021 which was 1660 days ago.

Since then, it has closed over this price 53.5% of times which is 604 trading days.

Previously, BSOFT closed above its last close price on Monday, January 19, 2026 which was 11 days ago.

Historically, this stock gave a non-positive return for a maximum period of 1691 days which was from June 11, 2021 to January 27, 2026.

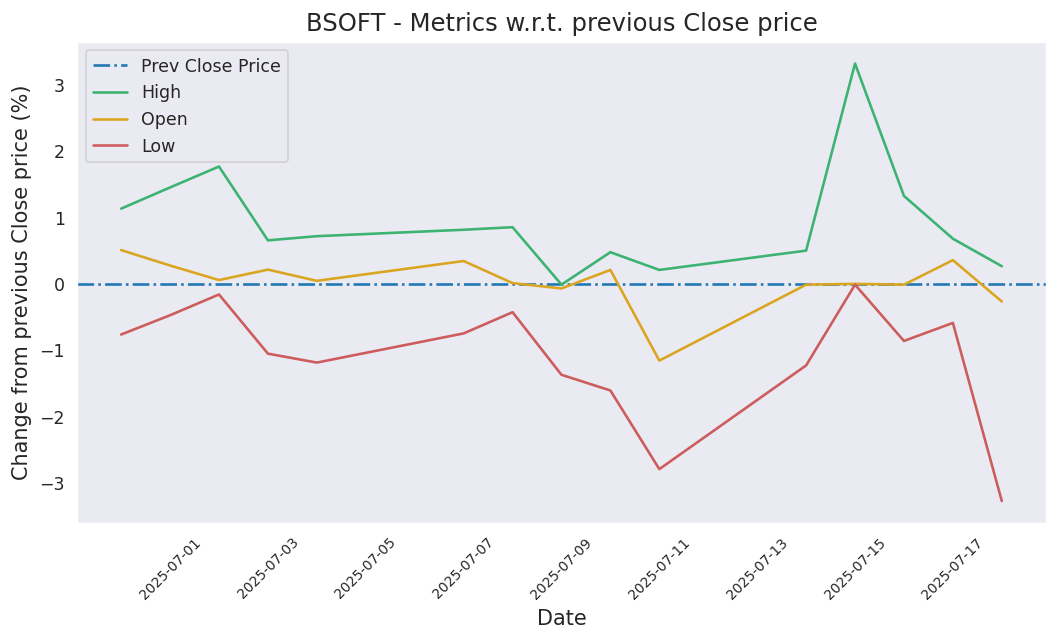

Last candle: Green (1.99%)

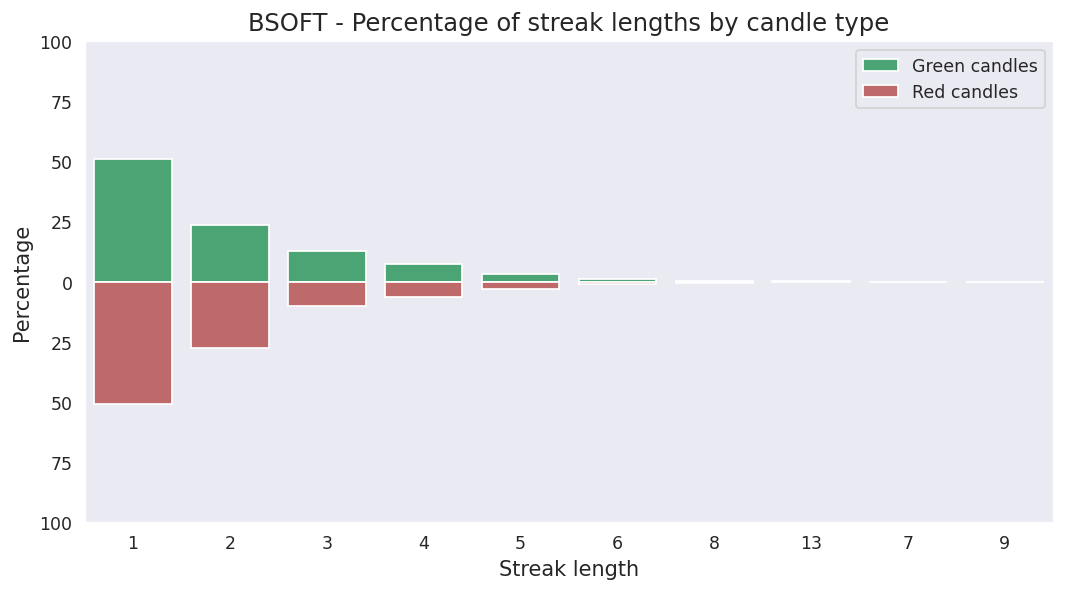

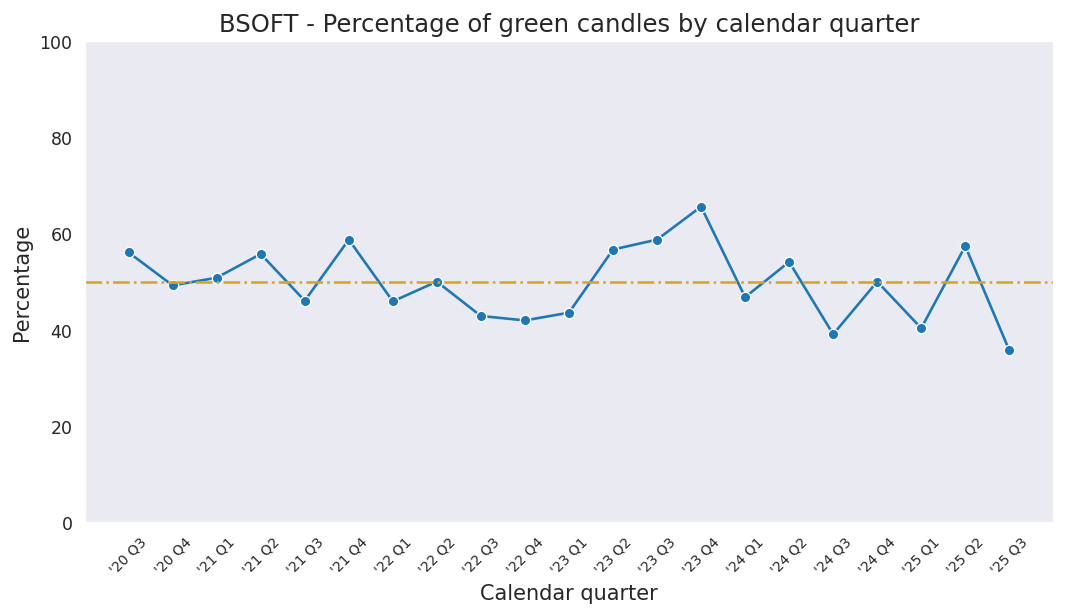

Overall percentage of Green candles: 50.3%

Current streak of Green candles: 3

Net change so far for the current streak: 4.85%

Probability of streak continuing: 50.0%

Longest streak of Green candles: 13 trading days from November 29, 2023 to December 15, 2023

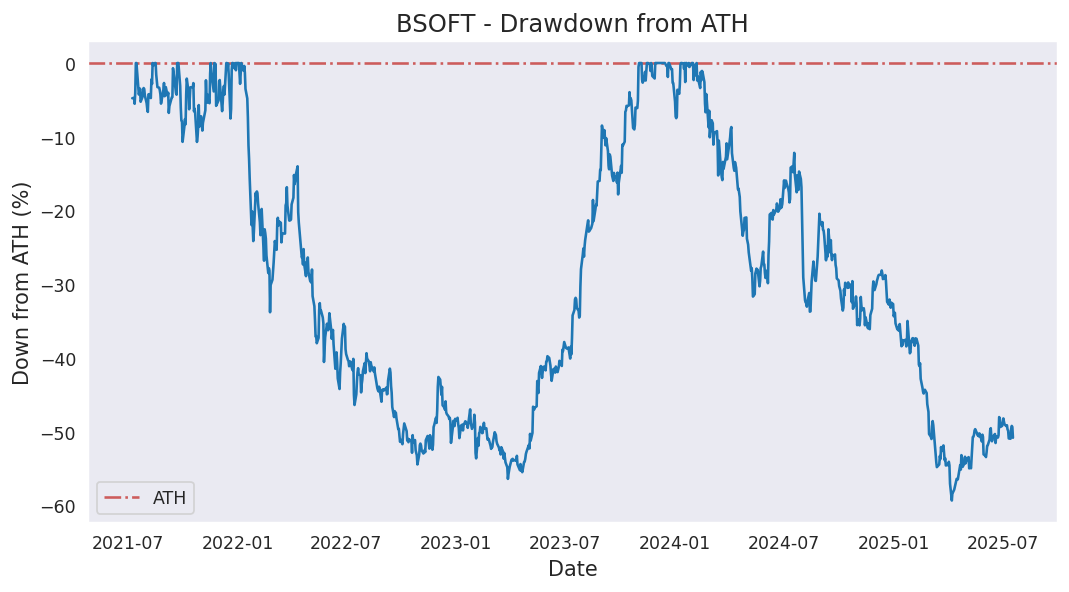

Current down from ATH: -51.01%

Most down from ATH: -60.28%

ATH hits in last 1000 days: 32

ATH was last hit on Tuesday, February 06, 2024.